Annual Compensation Limit 2025

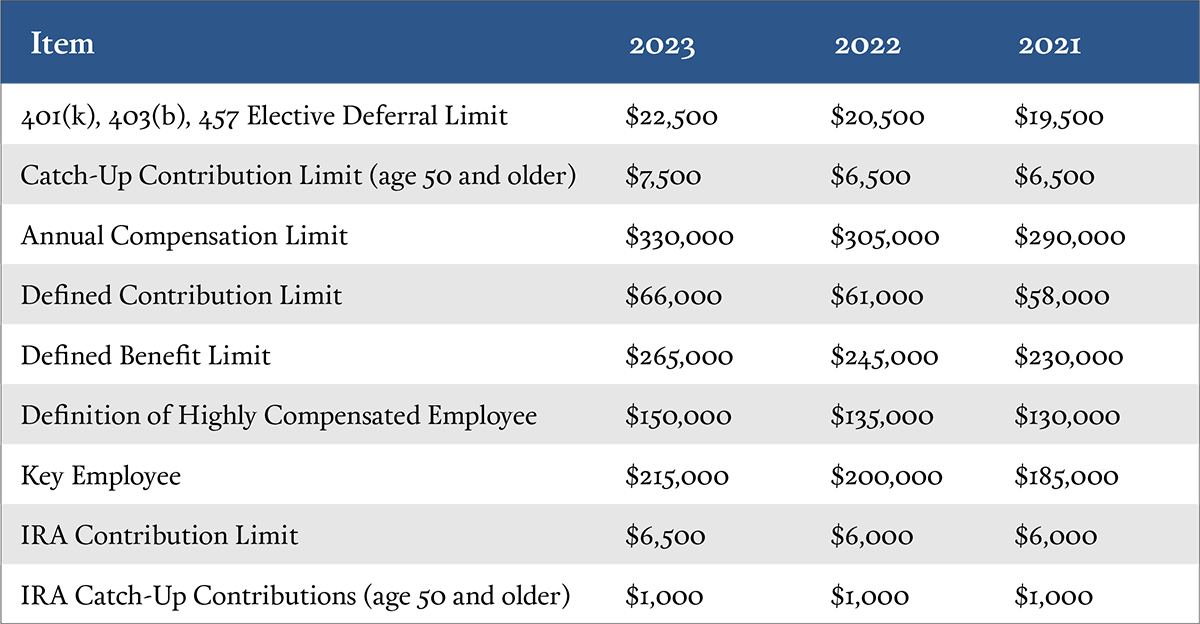

Annual Compensation Limit 2025 - For 2025, the dollar limit is $345,000 (up from $330,000 in 2025). Annual Retirement Plan Contribution Limits For 2025 Social(K), That's an increase from the 2025 limit of $330,000. Download a printable pdf highlights version of.

For 2025, the dollar limit is $345,000 (up from $330,000 in 2025).

What Is The Ira Contribution Limit For 2022 a2022c, Annual retirement plan contribution limits for 2025. 2025 benefit plan limits & thresholds chart.

Healthcare Marketplace Limits 2025 Danny Orelle, 2025 benefit plan limits & thresholds chart. Maximum benefit/contribution limits for 2018 through 2025, with a downloadable pdf of limits from 2013 to 2025.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, The limit on elective deferrals under 401 (k), 403. The compensation amount for simplified employee pensions (seps) remains unchanged.

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, 1 if annual compensation is less than the applicable limits shown, then the maximum contribution is limited to 100% of compensation. The annual compensation limit increased to $345,000, up from $330,000.

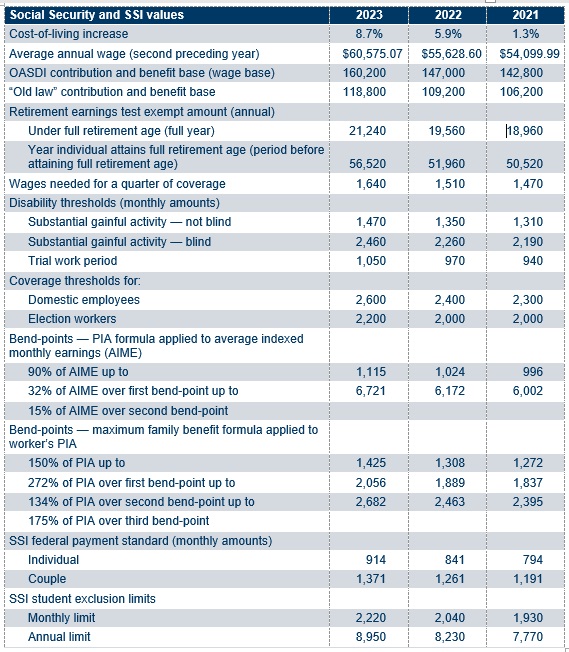

2025 Social Security, PBGC amounts and projected covered compensation, December 11, 2025 | kathryn mayer. The irs modestly increased the applicable limits for 2025.

Annual Compensation Limit 2025. 2025 benefit plan limits & thresholds chart. $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2025;.

New HSA/HDHP Limits for 2025 Miller Johnson, 2025 benefit plan limits & thresholds chart. Highlights of changes for 2025.

The following limits apply to retirement plans in 2025: The internal revenue service recently announced the new inflation adjusted dollar limitations for retirement plan contributions and benefits beginning january 1,.

2025 retirement plan contribution limits, 2025 retirement plan contribution limits. 2 if you contribute to a tda, 403 (b).

Irs releases the qualified retirement plan limitations for 2025:

2022 retirement contribution limits Early Retirement, 2025 benefit plan limits & thresholds chart. The annual compensation limit (applicable to many retirement plans) is increased to $345,000, up from $330,000.

Maximize Your Paycheck Understanding FICA Tax in 2025, For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's.